Worthy Wealth Housing Bonds

Earn 9% Annually (3 year term)

10% Annually in Years 4-5

Worthy Wealth Housing Bonds

Smart Investing Starts Here - High Yield Housing Bonds

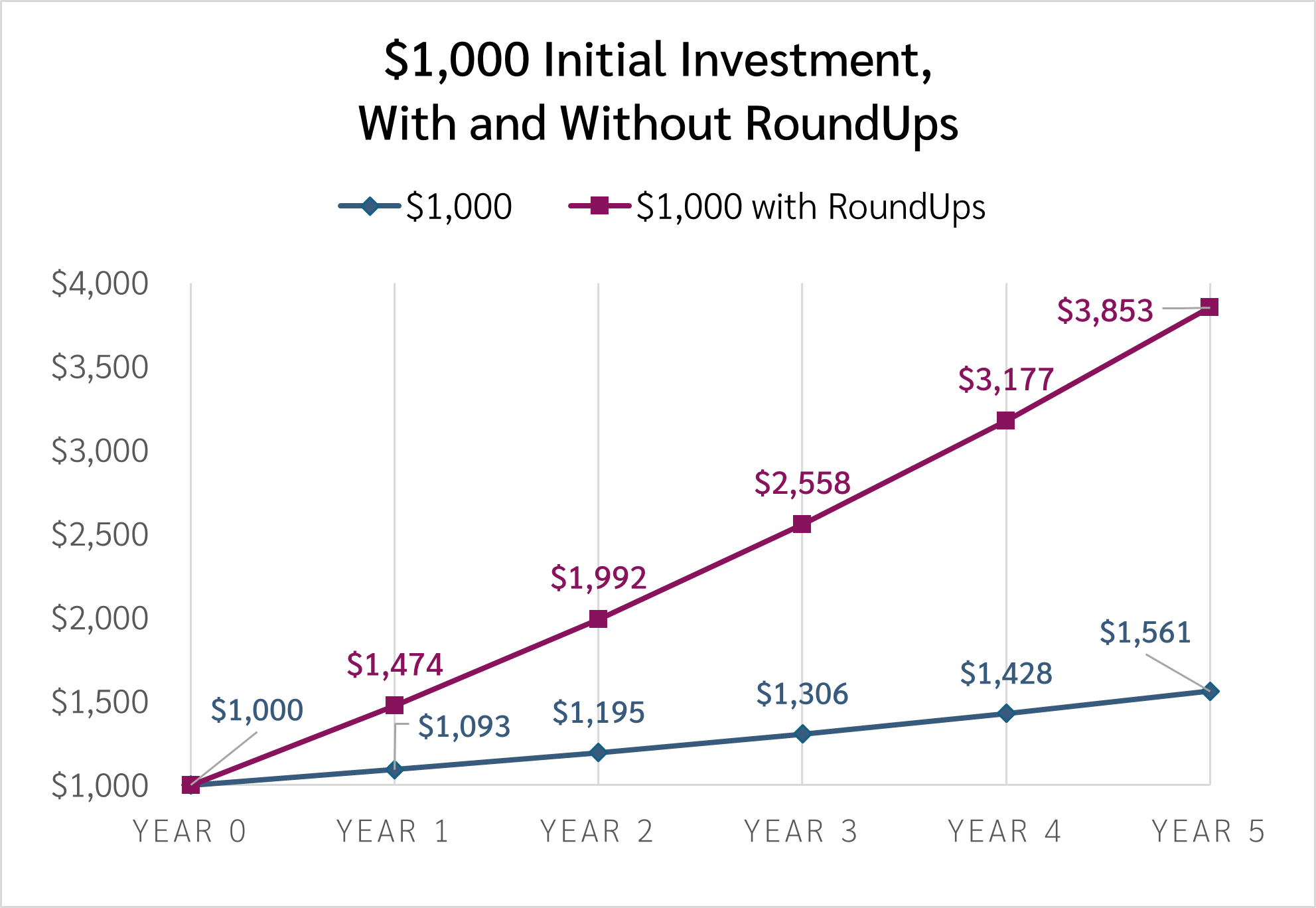

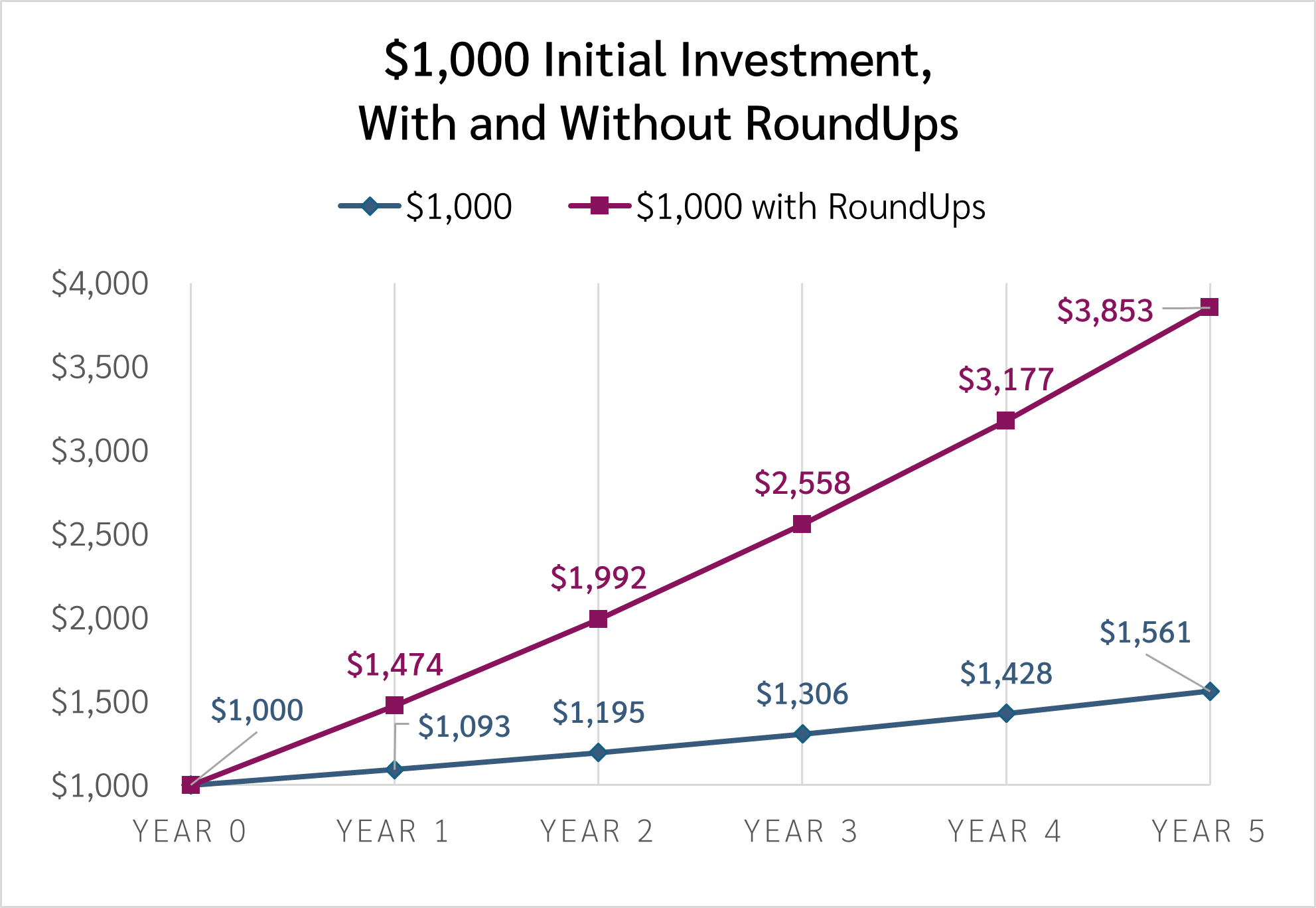

Are your savings stuck in neutral? Worried about market swings? It's time to discover a smarter way to grow your wealth. Worthy Wealth Housing Bonds offer a powerful alternative designed to help you achieve your financial goals with confidence and predictability.

The Problem: Why Your Money Isn't Working Hard Enough

You're not alone if you're frustrated with traditional investment options.

See how Worthy Wealth's Housing Bonds make real-estate backed investing easy and predictable while providing a buffer against recessions and drops in the market.

| Traditional Investment Options | Worthy Wealth Housing Bonds | |

| Earning Power | The national average for Treasury Bonds returns is 3.62%* |

Fixed 9% return in years 1-3, increasing to 10% in years 4-5. |

| Market Volatility | Stocks can lose significant value unexpectedly (e.g., historical drops of 20-30% or more), putting your principal at risk. | Bonds are backed by real estate which is historically protected from market volatility. |

| Predictability | Traditional investment accounts tied to public markets can see their returns change quickly, making them unpredictable. | Worthy Wealth returns are fixed and predictable. |

| Investment Amount | Real estate-backed investments often require tens of thousands of dollars to start. | Worthy Wealth Housing Bonds are only $10 each. |

| Return on Investment Period | Real estate-backed investments are often dependent on the sale of the property, which, depending on the market, may take years. |

Bonds earn interest every quarter and may be redeemed after three years. |

Every investor is different - but everyone is worthy of building a brighter financial future!

It's easy to get started. Click the button below to start growing your nest egg!

Disclaimer: This information does not constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction where such offer or sale is not permitted. All information is subject to change, and investors should conduct their own due diligence. Past performance of our operating partners is not indicative of future results. All investments involve risks, including loss of principal.

* As of October 2025